De Niro Socked With $6.4 Million IRS Tax Lien

Feds are dunning performer over his 2013 return

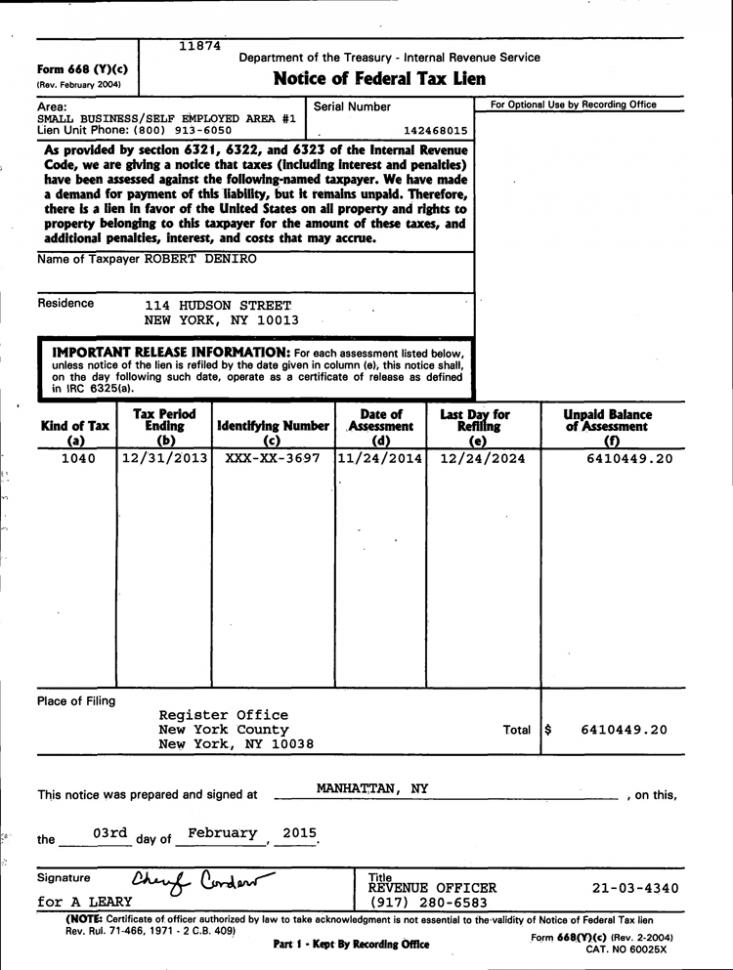

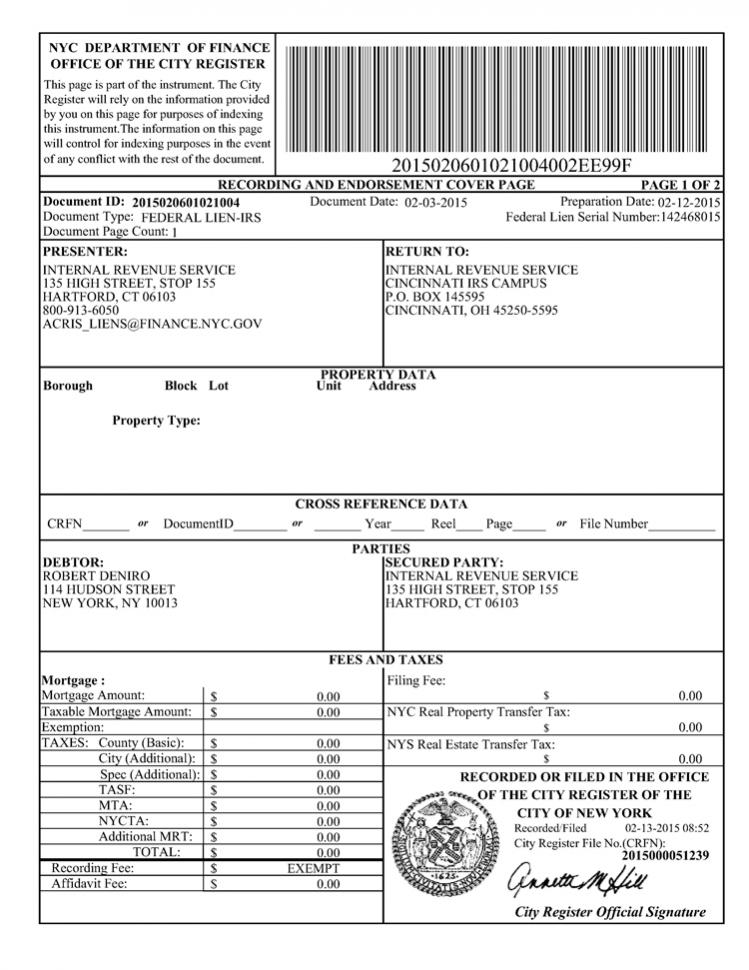

FEBRUARY 26--The Internal Revenue Service has hit Robert De Niro with a $6.4 million tax lien, according to records filed this  month.

month.

In a notice sent to New York City’s Department of Finance, the IRS reports that the 71-year-old De Niro owes the whopping bill in connection with his personal 1040 filing for 2013.

The federal tax lien reports that the two-time Academy Award winner owes the IRS $6,410,449.20, and that the hefty assessment was lodged against De Niro three months ago.

The February 3 lien lists De Niro’s residence as a Tribeca condominium that was developed by the actor and his real estate partners.

According to the IRS, the agency will file a lien against a taxpayer’s property when “you neglect or fail to pay a tax debt. The lien protects the government’s interest in all your property, including real estate, personal property and financial assets.” An IRS lien also serves as a warning to other creditors that Uncle Sam has a legal right to your property.

The dunning of De Niro was discovered by some intrepid researchers whose business involves the review of mountains of federal tax liens (and who plan on posting the notable ones at FamousTaxLiens.com). (2 pages)

2/26 UPDATE: In a statement this afternoon, De Niro spokesperson Stan Rosenfeld said that IRS delinquency notices had been “sent to an old address,” and that once the actor learned of the seven-figure tax lien, “he had a check for the full amount hand delivered to the IRS this morning.”